The project team leaves a positive impression; there were no discrediting facts about members discovered during the audit. In our opinion, the team has the necessary competence to implement the intended functionality in the event of a successful crowdsale.

Having studied the available information and written this review, we did not identify any significant risks that could negatively affect the price of the token.

The project has a low boom score, we found a very small community on social media.

General information about the project and ICO

Blockchain Agro Trading - absolutely new product, which has no analogues in the world. We are the first who implements Blockchain-technology in this business environment. We offer to use Blockchain to simplify the storage of cereals and their direct purchase and sale on a global scale. This will connect sellers (farmers, small and large farms) and direct buyers of grain crops (traders from other countries and grain processing plants) around the world. The simplicity, speed and transparency of asset movements in Blockchain will enable decentralized buying and selling of crops on the most favourable terms and without the risk of being deceived.

Smart contract platform: Ethereum blockchain

Contract type: ERC20

Token: BATT

Soft cap: 1,000 ETH

Hard cap: 33,366 ETH

Pre-Sale:

Start date: 11 June 2018

End date: 21 October 2018

Sale:

Start date: TBA

End date: TBA

Available token for sale: 1,530,000,000 BATT

Cost of 1 BATT: 0.000033 ETH

Accepted currencies: ETH

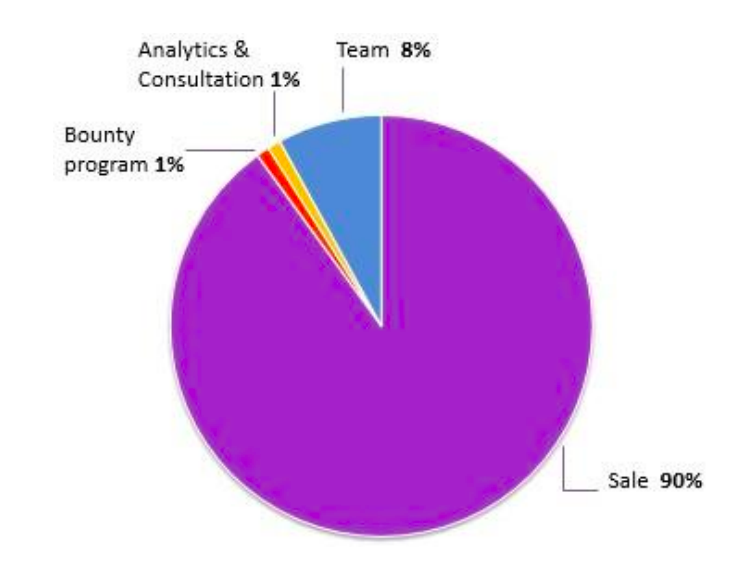

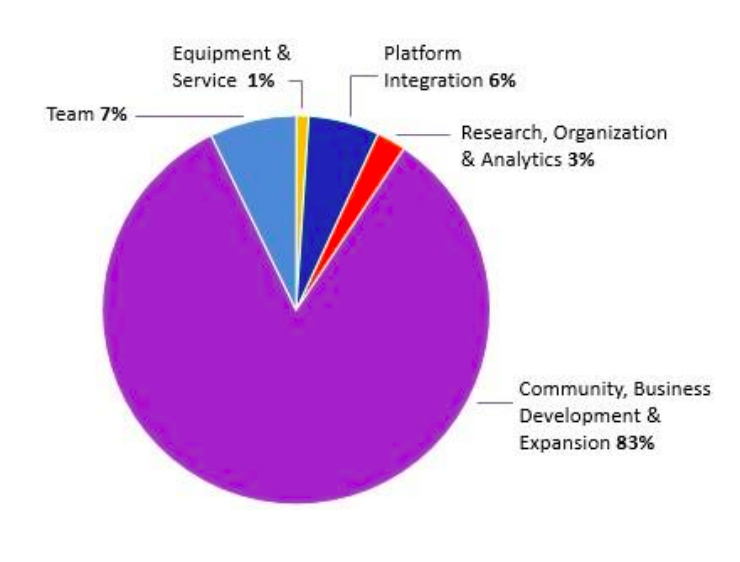

Distribution of tokens:

Funds raised from the ICO will be distributed as follows:

Project Description

Blockchain Agro Trading diversifies risks for the seller using high-tech grain moisture sensors in the flow and conductivity sensors for grain moisture with flat measuring electrodes, installing them at the grain collection point with automatic data input to the platform without direct human intervention. After that, the seller decides - to store the grain in the storage (if the grain corresponds to the moisture index for possible storage) or immediately sell. When unloading onto the elevator, the mass of the grain will be calculated on the basis of the Duval formula, after that the grain will be brought to the required condition. Further, the seller receives a warehouse receipt in the platform in electronic form (a smart contract) and can expect a better price, which will be automatically fixed by a smart contract, or sells it immediately. After all, the price inside the country (in countries with a large volume of harvest) is approximately twice less than when exporting to other countries, taking into account even the costs of delivery to the final point of shipment. Requests for purchase from other users will be visible in the platform. Having decided to sell, the seller instantly receives highly liquid tokens BATT on his account, using a smart contract. BATT tokens obtained as a result of the transaction the seller can immediately transfer into phatic money using a payment system that will be integrated into the platform, or buy the necessary goods and services for the BATT tokens.

BATT Offers:

- Transparency;

- Innovativeness;

- More Than Just a Guarantor of a Deal;

- Globalization;

- Minimizing the Human Factor;

- Continuous Quality Control;

- Safety;

- Decrease in Monopoly;

- Availability.

Market and Industry Review

The global algorithmic trading market is expected to grow to $18,160 million by 2025. The compound annual growth rate is projected to be 8,7% between 2017 and 2025.

Adoption of automated trading by a large number of investment companies will also accelerate the pace of growth. Various international markets aim to ensure global fund diversification and risk sharing. Algorithmic trading is intended to propel these processes.

The report "Algorithmic Trading Market 2025 Global Analysis and Forecasts" is focused on the segmentation of this market based on functions and applications. The order management segment had the largest share of the algorithmic trading market in 2016. The Asia-Pacific region is expected to show the fastest growth rates over the forecast period. North America is one of the major players in the market that will contribute the highest revenue globally due to technological developments and considerable application of algorithmic trading in different end-user segments (provision of solutions for investment companies’ clients). Rapidly growing economies in the Asia-Pacific (APAC) region, which demonstrate significant growth in the construction sector, will pave the way for further adoption and promotion of algorithmic trading solutions. The APAC region is expected to become the market leader with the highest CAGR over the forecast period.

Regarding the crypto industry, BATT’s potential market will depend on cryptocurrency market capitalization and the development and success of crypto and hedge funds.

Competitors

The project identifies the following competitors:

Competitors

The project identifies the following competitors:

- Tradingene - Tradingene will generate income in success fees from profitable algorithms, from auction participation fees, and from subscription charges for advanced modelling packages provided to creators. Tradingene will also sell analysis and market reviews to investors.

- Onam - ONAM is a truly scalable, High-performance, regulatory compliant, trading platform that features robust risk-management, trade surveillance, advanced trading tools and state-of-the-art enterprise-grade security system powered by machine learning.

- Lucre - LUCRE is an exclusive automated trading system & signal service for Cryptocurrencies, created to outperform the strategy of just holding Cryptocurrencies.

Summary: BATT plans to operate in a fast-growing but highly competitive market where simplicity and convenience, security and marketing budgets are key factors. Only time will tell whether the project is able to take its niche.

Marketing

Information about the project is available via popular services such as Twitter, Telegram, Reddit, Medium, Facebook, and BitcoinTalk. The project has a Bounty program.

The team is active on social media. Twitter and Facebook update project news regularly; there is a blog on Medium.

The format of articles about the project shows that they were written mainly at the project's request.

Comments: Project has very low numbers at social media; the marketing campaign is being developed mainly on Facebook and Twitter.

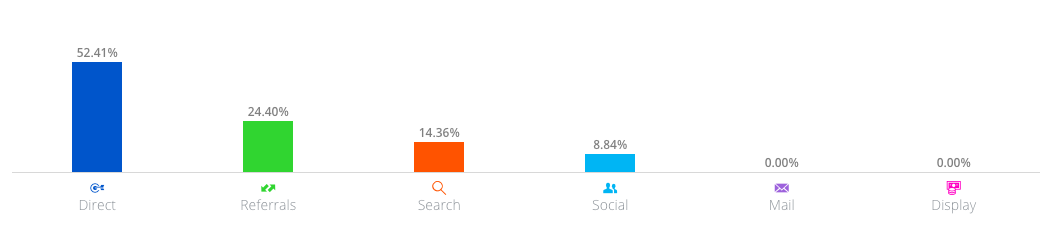

Traffic analysis of the BATT website based on Similarweb.com data showed the following:

Comments: direct link: 52.41%, referrals: 24.40%, search: 14.36%, social media: 8.84%, mail.

Search traffic: 14.36%, 100% from wich is organic.

Social activity: Instagram: 97.10%; VKontakte: 2.90%

Summary: Based on the available data, the community is not interested in the project.

Bounty Program

The project allocates 17 000 000 BATT (0.01% of all BATT issued) on the bounty; the program is open in the following areas:

- - BitcoinTalk - 15%

- - Youtube - 15%

- - Telegram - 15%

- - Twitter - 10%

- - Facebook - 15%

- - Redit - 10%

- - Instagram - 10%

- - Golos.io - 10%

Summary: The project has an extensive bounty program. All details of the program are available at the link above.

Team

There is a team of three core team members along with one advisor.

Key positions are occupied as follows:

Team members:

Vyacheslav Kopylov, CEO & Founder

A trader with eight-year experience of carrying out transactions in the field of cereals and mineral fertilizers. At the moment he acts as a private entrepreneur.

Education:

Kharkiv State Technical University of Architecture and Construction (2006 - 2012), Specialization - engineering technology.

Andrii Ovcharenko, CTO

More than 15 years of experience in managing large IT projects, head of the development department of Mria Agroholding (one of the largest agro-industrial holdings in Ukraine).

- 1C-TELLUR.Constanta (2001 - 2012), Project Manager

- Mriya Agro Holding (2012 - 2014), Head of software development division, IT Architector

- Yaware (2014 - 2015), Product manager

- Nova Poshta (2015 - 2016), IT Architect

- TQM systems (2016 - 2017), Project manager

- Global Ads Network (2018), CTO

- ROMAD Systems (2018 - Present), Blockchain development manager

- ZyxIT (2018 - Present), Chief business development officer (CBDO)

- Smart Contract Studio (2017 - Present), CEO & Founder

Education:

National Technical University of Donetsk (1998 - 2002), Specialization - Computer systems and networks.

Yaroslav Osolikhin, CFO

Engaged in business planning and strategic decisionmaking. More than 2 years of experience in writing business plans for energy, construction, passive houses, smart houses and metal.

Education:

Oles Honchar Dnipro National University (2015 - 2020), Specialization - Economy.

The project has seven more team members.

Advisors:

Andrey Gagun, LAWYER, CO-OPERATOR OF THE 'APG GROUP' COMPANY

More than 10 years of business support. The main directions: support of corporate deals, structuring of investments, M & A, support of economic transactions, dispute resolution, tax law, contract law.

Investment Risks

The success of the project will largely depend on the following:

- The amount of funds raised during the ICO: the more raised.

- Crypto market dynamics: if the downtrend continues, the economic efficiency of trading will fall.

- Competition: this is one of the most competitive segments of the crypto world.

Important risk that the team has only one advisor.

Other risks. These may arise due to intermediation activities in the financial and cryptocurrency markets. They revolve around legal and technological aspects, and cannot be foreseen in advance.

Total Rate