We believe that the purchase of CEL tokens at the project’s ICO could be interesting for future users of the platform and for investors with token portfolios.

The Celsius project is entering a promising and fast-growing market. In addition, there is growing competition in this market. The introduction of new technologies is widespread, and in this case use of blockchain will enable the project to buy some time and to occupy a market share. However, major players are aware of all the trends in financial technologies and will be implementing similar services for their customers. However, there is a certain inertia in large companies regarding the introduction of new technologies and procedures. A new player in the market is always more flexible, and clearly lacks any legacy solutions that need to be maintained.

Having studied the available information and written this review, we did not identify any significant risks that could negatively affect the price of the token.

General information about the project and ICO:

The Celsius Wallet will be one of the only online crypto wallets designed to allow members to use coins as collateral to get a loan in dollars, and in the future, to lend their crypto to earn interest on deposited coins (when they’re lent out).

Smart contract platform: Ethereum blockchain

Contract type: ERC20

Token: CEL

Soft cap: 3,600 ETH

Hard cap: 36,000 ETH

Pre-Sale:

Start date: 15 March 2018

End date: 16 December 2017

Sale:

Start date: 15 March 2018

End date: 22 March 2018

Available token for sale: 325,000,000 CEL

Cost of 1 CEL: $0.2 for Presale and $0.3 for Crowdsale

Accepted currencies: BTC, ETH, USD

Bonus program: From 20% for Presale

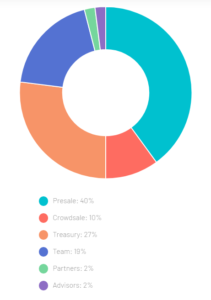

Distribution of tokens:

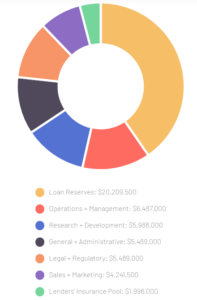

Funds raised from the ICO will be distributed as follows:

Project Description:

The team of the project built companies from the ground up, served hundreds of millions of users and completed multiple exits for billions of dollars (including an IPO). This isn’t their first rodeo. The team of experienced entrepreneurs knows how to take a concept from ideation to full execution on a global scale.

Founder, Alex Mashinsky, has filed over 30 patents including the original patent on VoIP technology. He previously founded several multi-billion dollar businesses including Arbinet (IPO 2004), transmit wireless and GroundLink. A crypto holder since 2013, Alex serves as an advisor and investor to several Blockchain companies including Sirin Labs, MicroMoney and Ties Network.

The team believes the future of lending and borrowing will manifest itself in a P2P decentralized environment on the blockchain. In their view, traditional financial institutions should no longer control the flow of credit to people across the world. The team wants to use a consensus-based, Proof-of-Stake approach to allow the Celsius community to borrow, lend and vouch for each other, creating a truly win-win-win self-governed solution for people involved in every step of the credit ecosystem.

Celsius Offers:

- the ability to become a member of the Celsius platform and community

- the ability to deposit your cryptocurrencies in the Celsius wallet

- the ability to apply for dollar loans with cryptocurrencies as collateral

- the ability to pay interest on these loans at a discount

- allowing members to lend cryptocurrencies in order to gain interest

- achieving seniority in the platform which will impact the interest rate gained

- get interested rewards on cryptocurrencies lent

Celsius is conducting a crowdsale in order to achieve project goals: a decentralized network of good actors who will be supported by loans and credit. The project wants people to contribute to our crowdsale who not only want to get loans in dollars using their crypto as collateral but who also believe in project mission to expand the crypto community and the future of credit on the blockchain.

Market and Industry Review:

Over the past few years, interest in cryptocurrency has grown exponentially. Total market capitalization at the beginning of 2018 exceeded $500 bln. Currently, the most capitalized cryptocurrency is Bitcoin. The market capitalization for the top five cryptocurrencies exceeds 70% of total market capitalization, and the total number of cryptocurrencies and tokens now exceeds 1500.

From the middle of January and throughout February the market was susceptible to sharp drops and gradual recovery. Capitalization is currently ¾ (three-fourths) of the value of cryptocurrencies at the beginning of 2018.

The middle of January and February demonstrated the extremely high correlation between the prices of most of the Top 100 cryptocurrencies and total cryptocurrency market capitalization during a period of downward adjustment. Bitcoin’s gradual recovery of its position should be noted. Its dominance has begun to grow and exceeds 40%.

You will recall that its dominance fell abruptly, by nearly half to 33%, in the second week of January, i.e. Bitcoin was the harbinger of the subsequent serious downward adjustment of the entire market. Most cryptocurrencies follow its lead, with a certain lag time. Therefore, one can conclude that the growth in Bitcoin will serve as an impetus for the recovery of other cryptocurrencies.

Wallet providers are actively implementing new features and enhancing wallet convenience, security, and accessibility as well as a growing list of supported currencies and methods for their deposit/withdrawal.

The market for payment services is developing in line with other segments. In this study, the authors collected data from 48 companies providing these services in 27 countries. Most of them are European, while the maximum number of companies are based in the UK and the USA (15% of the total. It should be noted that Celsius is registered in the US, the world's largest financial center). More than 79% of payment operators maintain relationships with the banking sector and payment networks, however, the difficulty of maintaining these relationships is a defining problem for the market.

Thus, the potential market for the Celsius is quite large, and its development will certainly be related to the popularity and penetration of cryptocurrency in the global financial system.

Documentation:

We have analyzed the Celsius website and documentation for sufficiency and consistency for making an investment decision.

Information about the project is available in the White Paper and Tech Paper in English.The project is described in detail in the white paper; the main emphasis is placed on the description of the platform’s operation.

The website also provides information about the project, the ICO, the Roadmap, and bonuses, the blog, frequently asked questions with answers, consultants and the team. The website is presented in English, Russian, Chinese. The website features links to the blog and social media.

Tech Paper shows the great overview of the platform. Also, there is information about the economy of the token.

Summary: The documentation offers insight into the project; platform operation and the services provided are described in sufficient detail.

The economy of the project:

The project’s economy is based mainly on commissions from providing customers with payment operations.

The Celsius Degree Token (CEL) is converted from fees paid by borrowers (margin traders). This fee, although charged in fiat, is converted to CEL tokens by the Celsius service and distributed to the lenders’ wallets as a daily interest:

- A trader that places a margin trade order is required to pay a dollar fee, in addition, a daily commission is charged as long as the position remains open.

- Celsius releases CEL tokens from an internal cache according to the value of the fees and commissions. If needed, CEL tokens may be purchased on open markets.

- The Celsius Service distributes to the lenders their CEL token rewards on a daily base.

- Lenders may buy/cell CEL tokens on open markets as desired.

In summary, we point out that the business model is based on projected growth in the number of clients.

Team:

There is a team of four core team members, along with seven advisors.

Key positions are occupied as follows:

Team members:

Alex Mashinsky, CEO

Alex has received numerous awards for innovation, including being nominated twice by E&Y as entrepreneur of the year in 2002 & 2011; Crain’s 2010 Top Entrepreneur; the prestigious 2000 Albert Einstein Technology medal; and the Technology Foresight Award for Innovation (presented in Geneva at Telecom 99).

Work experience:

- Tellabs (2013) , Board member

- Inseego Corp. (2014 - 2015), CEO

- Transit Wireless (2003 - 2016), Founder and Chairman

- Governing Dynamics (2004 - Present), Founder

- Sirin Labs (2017 - Present), ICO advisor

Education: The open University of Israel (1980 - 1982), specialization - Bachelor of Engineering. Tel Aviv University (1987 - 1989), specialization - Economics

S. Daniel Leon, President and COO

Daniel Leon is a business and social entrepreneur with a proven track record of growing early-stage companies and building organizations from the ground up.

Work experience:

- Ground Link (2008 - 2012) , General Manager

- Beyon3D (2012 - 2014), CEO

- Atlis Labs (2014 - 2017), Founder and CEO

- Governing Dynamics (2017 - Present),Managing partner

Education: Brown University (1997 - 2000), specialization - Economics.

Nuke Goldstein, CTO

Nuke is a seasoned software developer, architect, innovator, and entrepreneur in cutting-edge technologies.

Work experience:

- Syncline (2002 - 2003) , Project Lead

- Zeyfo (2010 - 2011), Founder

- The Carbon Project (2003 - 2012), Founder and CTO

- Sevenpop (2011 - Present), Founder and CEO

Education: Israel Institute of technology (1992 - 1997), specialization - Computer science.

Keith Baumwald, CMO

Keith has spent his career as a full-stack marketer working for startups, agencies and large corporates.

Work experience:

- Shoplet.com (2009 - 2010) , Interactive marketer

- GroundLink (2010 - 2011), Director of online marketing and eCommerce

- Travelex (2011 - 2015), Director of online marketing, Head of online and mobile, Global Head of R&D

- Leverag Consulting (2015 - Present), Founder

Education: The University of Georgia (1995 - 1999), specialization - History. The Hebrew University of Jerusalem (2004 - 2006), specialization - Middle Eastern Political science.

Advisors:

Moshe Hogeg, Founder & Co-CEO at Sirin Labs

Jeff Pulver, Industry Pioneer

Chris Dannen, Business Strategy

Miko Matsumura, Co-founder at Evercoin

Dr. Elliot Noma, Algorithm/AI Developer

Anton Dzyatkovsky, CEO of MicroMoney

Ivan Bjelajac, Operating Director at GoDaddy / Partner MVP Workshop

Investment Risks:

The financial model is not presented in the documentation. Thus investors will not be able to assess the realism of the costs of any of the plans.

Another risk that could affect the successful implementation of the project is the lack of a lock-up period for the team’s tokens.

We have not identified any other significant risks.

Total Rate: