Currently, there are too many projects on the ICO market which are trying to attract money; market statistics for the last 2-3 months shows that many do not reach the intended level of revenue. However, quality projects will certainly be of interest. We can regard this project as high in quality and recommend investors to participate in the ICO.

The company has a clear marketing strategy and a team of high-end marketing professionals. This has a significant impact on the interest in the project on social media.

General information about the project and ICO:

The Fund Platform is a solution for digital funds, which is a blockchain platform that allows for the fastest and most affordable way to implement tokenization, investment, and crowd-funding processes. Any user of the Fund Platform can create its own digital fund for absolutely any tasks in just a few minutes and much cheaper versus an independent development of a fund.

Platform: NEM

Token: FUND

Soft cap: 1,300,000 USD

Hard cap: 30,000,000 USD

Sale:

Start date: 3 April 2018

End date: 3 May 2018

Available token for sale: 100,000,000 FUND

Cost of 1 FUND: 0.1 USD

Accepted currencies: XEM, BTC, ETH, BCH, DASH, NEO, LTC, XRP, ETC

Bonus program: From 0% to 20%

Distribution of tokens:

60% - For sale through the ICO

25% - Product Development

10% - Fund Platform Founders

5% - For Advisors and bounty program

Project Description:

The Fund Platform is a solution for digital funds, which is a blockchain platform that allows for the fastest and most affordable way to implement tokenization, investment, and crowd-funding processes. Any user of the Fund Platform can create its own digital fund for absolutely any tasks in just a few minutes and much cheaper versus an independent development of a fund. To date, the test platform model is already functioning, where our customers create their funds and issue tokens.

Tokens and subtokens. One of the advantages of the NEM platform, which is the basis for the FundPlatform.io, is the ability to create of subsidiary tokens, which in turn will allow to create subsidiary tokens on the basis of a Fund token and to reduce the value of the fund. The quantity of the created subsidiary tokens is unlimited and will allow investors to choose suitable fund products according to requirements of profitability and risks. All this will simplify a goal of creating the fund to a simple, one, two, three.

Licensing and expanded functions. The undoubted advantage is a legal service and an expanded set of options, as currency deposit/withdraw on the exchanges without API, reduced fees for the platform certified funds. Certification takes passes with the signing the contract between fund and FundPlaftorm.io and depositing into the reserve fund by the founders of a fund. Analysts of a platform will consider funds with a low risk and an increased profitability, and by certifying only the best companies.

Crypto Angel Offers:

- Transparency;

- Financial stability;

- Security and privacy (data protection);

- Innovativeness;

- Customer satisfaction;

- Market share growth and worldwide expansion;

- Profit for all stakeholders.

- an opportunity to create a crypto fund early as a turnkey solution. an opportunity to invest in funds without paying any fees.

- To make the marketplace where an end user can buy various categories of knowledge

A fund comes up with an idea for a platform, pays for marketing, technical and legal support and gets investments from investors’ pool on the platform

Functional Structure:

Market and Industry Review:

In our opinion, the Fund Platform project intends to start in a very actively growing market, which could certainly increase the chances of a successful launch and subsequent expansion of the business.

The Autonomous Next company, a leading researcher and analyst in the financial technology industry (fintech), reported that 124 hedge funds are investing in cryptocurrency assets. The world's most popular cryptocurrency convinces finance managers, who manage more than US$2 bln, that this is the right time for investment.

In 2017 more than 90 digital asset-oriented funds were launched, bringing the total to 124.

37% of such funds used venture investment strategies with US$1.1 bln assets in management. Autonomous Next estimates that, in general, "assets in the management of crypto funds now comprise US$2.3 bln".

More than 100 cryptocurrency hedge funds ensured the growth of ICOs and related investments up to US$3.6 bln. This underlines that the crypto economy is moving faster and faster in regulation, assets, and new financial ecosystems.

However, there is no clear position on crypto funds in the financial market. Some participants see great opportunities for investment, while others look at the situation with a fair degree of skepticism. It should also be noted that digital assets have a high volatility and unpredictability. There are issues with cryptocurrency reputation and uncertainty about its regulation in most countries. Not all hedge funds can boast of famous founders, big portfolios, and a reliable history. The experts agree on one thing: As long as digital currencies are updated one at a time, new and new crypto funds will appear on the market.

Competitors:

The market for cryptocurrency and crypto assets is currently growing, and the number of funds is also increasing. There will be new specialized platforms that make it easy to create and maintain crypto funds for managers and traders. Thus, competition for Fund Platform in the near future is likely to increase.

The project identifies the following competitors:

- ICONOMI - The ICONOMI Digital Assets Management Platform is a new and unique technical service that allows anyone from beginners to blockchain experts to invest in and manage digital assets.

- Melonport - Melonport AG was officially founded by Reto Trinkler and Mona El Isa in July of 2016. It is a fully partner-owned, private company domiciled in Zug, Switzerland. In February of 2017, the company issued 599 400 MLN tokens, raising a total of CHF 2.5 million in under 10 minutes. Melonport AG is solely responsible for the development of Melon, the asset management computer.

- Tokenbox - Tokenbox is a platform that intends to offer professional managers and traders a ready-made tool for creating their own cryptofund based on the Ethereum blockchain.

Marketing

Information about the project is available via popular services such as Twitter, Telegram, Reddit, Facebook, YouTube, LinkedIn, Medium and BitcoinTalk. The project has a Bounty program.

The team is active on social media. Twitter and Facebook update project news regularly;

The format of articles about the project shows that they were written mainly at the project's request.

Comments: Project has very good numbers at social media; the marketing campaign is being developed mainly on Facebook and Twitter.

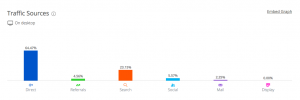

Traffic analysis of the Fund Platform website based on Similarweb.com data showed the following:

Comments: direct link: 64.47%, referrals: 4,56%, search: 23,15%, social media: 5,57%, mail: 2,25%

Search traffic: 23,15%, 100% from with is organic.

Referral links: 4,56%

Social activity: LinkedIn: 50,04%; Facebook: 20.92%

Summary: Based on the available data, the community is interested in the project.

Roadmap:

We can see that the project has clear plans and a time-frame for their implementation. The project's creators expect a smooth development for Fund Platform, which depends on the success.

Team

There is a team of five core team members, along with eight advisors.

Key positions are occupied as follows:

Team members:

Nikita Shevchenko, Founder/ CTO

Nick Shevchenko is a trend-setting IT entrepreneur and a seasoned young CEO

Education: Moscow Technical University of Communication and Informatics (MTUCI), specialization - Сomputer science and engineering

Yulian Lazovskiy, Chief Strategy Officer

Vice-president, Business development manager Mikro Kapital sarl Management company

Work experience:

- Institute of European Civilization (2002 - 2005), Financial Direcrtor

- CB «MDM-Bank» (JSC) (2005 - 2007), Project Manager

- Commercial Bank “ROSENERGOBANK” (2007 - 2008), Vice President

- Mikro Kapital Sàrl (2008 - Present), Vice President

Education: University of S. Vyshinski in Warsaw, specialization - Philosophic technological faculty

Igor Sannikov, COO

Work experience:

- Procter & Gamble (2012 - 2015), Blade Making Area Leader

- Zavento (JSC) (2015 - Present), Managing partner and co-founder

Education: Saint-Petersburg State Politechnical University, (2008 - 2014) specialization - Managerial Economics

Andrey Zaikin, CMO

Work experience:

- National mediaoperator MediaNet (2016 - 2017), Programmatic and performance buyer

- Humaniq (2017), Digital Media Manager

- ADV MS (2017), Digital Buyer

- Mikro Kapital Sàrl (2008 - Present), Vice President

Education: Moscow State University of Psychology and Educacion (2011 - 2015), specialization - Extreme Psychology

Alex Kazakov, Chief Product Officer

Work experience:

- CDTP, Ltd (2005 - 2011), Engineer Design

- Crocus Group (2016 - 2018), Senior Specialist

Education: South Ural State University (2002 - 2007), specialization - Engineering

Advisors:

Boris Otonicar, Blockchain Specialist

He consults companies how to implement the blockchain in their business or advise companies for an ICO.

Yaliwe Soko,

experienced Cryptocurrency / Blockchain consultant and Advisor. Currently working on a Cryptocurrency curriculum for rookies to be available early next year.

Sergey Surov, Chief financial and strategic advisor

Avner Engler, Blockchain expert

Jonathan Galea,

Jonathan Galea is a graduated lawyer warranted for legal practice in Malta, with a niche interest in the blockchain technology, Bitcoin, and other cryptocurrencies, as well as a general interest in Anti-Money Laundering Law and Gaming Law.

Andrey Levi, international law advisor

Alex Filatov,

Professional director, advisor to EY Entrepreneur of the Year Program, Russia

Maskal Boipai,

Australian digital currency network Pty Ltd

Investment Risks:

Fund Platform founders claim that there are no similar services to date and that the product will be in demand. However, in our view these statements are debatable; competition in the market does exist. It is not possible to say that a completely new product is being created, and in addition to the usual competitors listed in the chapter "Competitors and competitive advantages of the project," There are a large number of single funds that do not need such services; however, investor money is competition.

Currently, there is no working version of the product, the platform is scheduled to commence operation in Q1 - Q2-2019; this can greatly reduce the number of potential investors.

Total Rate