The idea of Forty Seven Bank bundle to create innovative, flexible and open Application Platform for financial technology developers.The Forty Seven Bank concept is not complicated, but it could be useful to developers with small or medium capital to create white label applications.

The project team leaves a positive impression; there were no discrediting facts about members discovered during the audit. In our opinion, the team has the necessary competence to implement the intended functionality in the event of a successful crowdsale.

Having studied the available information and written this review, we did not identify any significant risks that could negatively affect the price of the token.

General information about the project and ICO

The mission of Forty Seven Bank is to create innovative, flexible and open Application Platform for financial technology developers, who will be able to operate under the roof of Forty Seven Bank, having access to banks infrastructure and customer base. Forty Seven Bank will give the opportunity to developers with small or medium capital to create white label applications which will be able to compete with traditional banks. Their Bank as a Service (BaaS) solution will disrupt a financial sector of the European Union by reducing barriers to entry the fintech market.

Smart contract platform: Ethereum blockchain

Contract type: ERC20

Token: FSBT

Soft cap: 3,600 ETH

Hard cap: 36,000 ETH

Pre-Sale:

Start date: 16 November 2017

End date: 16 December 2017

Sale:

Start date: 16 December 2017

End date: 31 March 2018

Available token for sale: 11,063,829 FSBT

Cost of 1 FSBT: 0.00393 ETH

Accepted currencies: BTC, ETH, EUR, USD

Bonus program: From 0% to 30%

Distribution of tokens:

90% - For sale through the ICO

5% - For Founders

5% - For Bounty

Project Description:

Forty Seven Bank is innovative financial technology start-up aiming to provide high quality, secure and user-friendly banking services for individual and institutional consumers, which will be fully recognized by the financial authorities and compliant with the regulatory framework.

The bank is going to be specializing in digital finance services by fully supporting cryptocurrencies and traditional fiat currencies.

Basic cryptocurrency procedures include the sale and purchase features, investment and exchange options and crypto-saving and current accounts. Multi-Asset Account will be one of the featured innovative products offered by Forty Seven Bank – it will allow customers to have access to all their accounts in different banks and crypto wallets as well as to their investments and savings in cryptocurrency and fiat equivalents via a single application. It will be possible to operate with each asset type accordingly by having only one Multi-Asset Account at Forty Seven Bank.

Forty Seven Bank Offers:

- Transparency;

- Financial stability;

- Effectiveness and user-friendly procedures;

- Security and privacy (data protection);

- Innovativeness;

- Customer satisfaction;

- Market share growth and worldwide expansion;

- Profit for all stakeholders.

- Unique crypto products like bonds, futures, and options.

- Companies will be able to attract finances via product invented by Forty Seven Bank – Cryptobonds.

- Cryptobonds will be traded on various exchange platforms (mainly at the one developed by Forty Seven Bank).

- Products for private persons

Forty Seven bank going to use biometrics. Clients will pass full procedure of identification. After the completed procedure the client can access bank services. Types of identification are illustrated below:

Market and Industry Review:

The Banking sector is characterized by intense competition at the product and service levels, as well as a high degree of innovation as financial services can be provided through remote channels. Given the stiff competition and heavily saturated market, expert support in the form of specialist research findings is often invaluable.

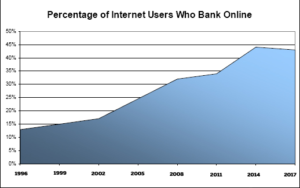

Now we see how to grow online banking every year. Offline banks lose their customers every year. While the percentage of internet users banking online is holding steady, internet users are increasing the frequency of their visits to banking and other financial websites. According to comScore Media Metrix, the number of unique visitors to Business/Finance websites grew by 9% between April 2016 and April 2017

According to comScore Media Metrix, in the period from 2005 to 2018, the social media market showed active growth from 5% active world users in 2005 to 65% active world users in 2018.

According to Pew Research Center, in the period from 1996 to 2017 the Banking sector showed active growth:

Documentation:

We have analyzed the Forty Seven Bank website and documentation for sufficiency and consistency for making an investment decision.

Information about the project is available in the White Paper, One Pager, Business model, Financial model, Token holders benefits in English. In the White Paper, the project is described in sufficient detail. The main emphasis is on the components of the platform. One pager provides most valuable info on one page. Token holders benefits are unique. This is a great advantage over other projects. The business model is great. Forty seven bank has very good business partners for a lot of structures of the company. The financial model shows the stability of the company. Forty seven bank will keep as much capital as it is needed in order to be protected from any types of risks.

The website also provides information about the project, the ICO, the Roadmap, bounty and bonuses, the blog, frequently asked questions with answers, consultants and the team. The website is presented in English, Russian, Spanish, Italian, German, Korean, Turkish and Portuguese. The website features links to the blog, a description of the bounty program and frequently asked questions.

Summary: The documentation enables a comprehensive view of the project. The work process of the platform is described in sufficient detail.

Roadmap:

According to the development plans, the team will focus on obtaining licenses and the technical development of the platform. Unfortunately, there is no information about scaling or marketing strategy, and the plans are not tied to time intervals.

Team:

There is a team of five core team members, along with eight advisors.

Key positions are occupied as follows:

Team members:

Alexander Malin, CEO and Founder

Strong business development professional with a Master's degree focused in Information Technology.

Work experience:

- World Cyber Games (2005 - 2009), Community Manager

- iAM.works (2011 - 2017), CEO and Co-Founder

- Bilderlings Pay (2015 - 2017), Senior Managing Director and Co-Founder

- Lita (2014 - Present), President

Education: Transport and Telecommunication Institute (2005 - 2009), specialization - Computer and Information sciences

Igors Astapchiks, COO

Strong business development professional. Experienced Chairperson with a demonstrated history of working in the information technology and financial technology industries.

Work experience:

- iAM.works (2011 - 2017), CEO/COO and Co-Founder

- Bilderlings Pay (2015 - 2017), Senior Managing Director and Co-Founder

- Lita (2014 - Present), Chairman of the board

Education: Baltic international academy (2009 - 2012), specialization - Economics

Mihails Skoblovs, CFO

Experienced and talented professional in business development and finance. Strong analytical and problem solving skills help to develop successful strategies in different situations.

Work experience:

- Forus Bank (2012 - 2013), Financial Department Specialist

- SIA BIOSAN (2010 - 2011), CFO Assistant

- SIA bioscience media (2011 - 2016), Co-Founder

Education: Stockholm School of Economics in Riga (2005 - 2015), specialization - Economics, ROI Marketing, Sales leadership

Vladimir Tomko, CMO

Experienced Game Producer with a demonstrated history of working in the internet industry. Strong arts and design professional skilled in Medieval History, Game Design, PHP, Computer Science, and Casual Games.

Work experience:

- Riga Technical University (2010 - 2014), Doctoral Student and Lecturer

- Amber Games (2011 - 2014), Lead game designer

- insta.ad (2015 - 2017), COO

- OK.RU (2014 - Present), Game Producer

Education: Riga Technical University (2005 - 2010), specialization - Computer science

Aristoteles V. Daza, Head of financial market development

Work experience:

- PDVSA (2005 - 2009), Oli movement tank farm intern and trading assistance

- BP (2009 - 2010), Analyst

- SAVI Trading (2011 - 2012), Trader

- Golden Capital ltd (2012 - 2017), Trader

Education:

- The University of Birmingham, specialization - MBA

- University of London, specialization - Banking and Finance Law

Advisors:

Claude Chi, Chief Marketing Officer, Afterpiece Investment

Has experience at On-Chain as president.

Morten Hansen, Head of Economics Department, Stockholm School of Economics in Riga

Dmitry Dudin, Head of Products and Services Development Department, XB Software

Rinat Arslanov, Chief Executive Officer, Revain

Artem Kushik, Business Analyst, Crédit Agricole CIB

Igors Danilovs, CFA, Senior Portfolio Manager, Swedbank

Jevgenij Plams, Blockchain Developer

Inna Krievane, Financial Analyst, Argus Vickers

Investment Risks:

The Forty Seven Bank Token(FSBT) sale highly depends on the private developers.

The platform application is not clearly illustrated in the platform in the whitepaper.

The percentage share of the token profits is not stipulated.

Total Rate: