Daox is a blockchain-based platform that provides a complete solution for ICOs, crowdfunding, and crowd investing using cryptocurrencies.

The project has an interesting idea and a team of highly motivated professionals. The technological solutions seem to be sensible and appropriate. The platform is not overloaded with features and does not have any unnecessary additional functionality.

All in all, we think the project looks promising and we have given it a high rating.

General information about the project and ICO:

Daox is a solution that lets startups and investors form fundraising decentralized autonomous organizations (DAOs) on the Ethereum blockchain. Fundraising DAOs play the role of advanced intermediaries between startups and its investors providing a leap forward in the efficiency of investing and raising funds. They are lowering the risks for both investors and startups and also have many other benefits such as transparency in business relations, easy communications, decentralized decision making, complete independence, and of course engagement into the Daox Ecosystem.

Smart contract platform: Ethereum blockchain

Contract type: ERC20

Token: DXC

Soft cap: 4,500,000 USD

Hard cap: 300M DXC

Pre-Sale: Start date: 20 June 2018

End date: 30 July 2018

Sale: Start date: 31 July 2017

End date: 13 September 2018

Available token for sale: 300 000 000 DXC

Cost of 1 DXC: 0,000355 ETH

Accepted currencies: ETH

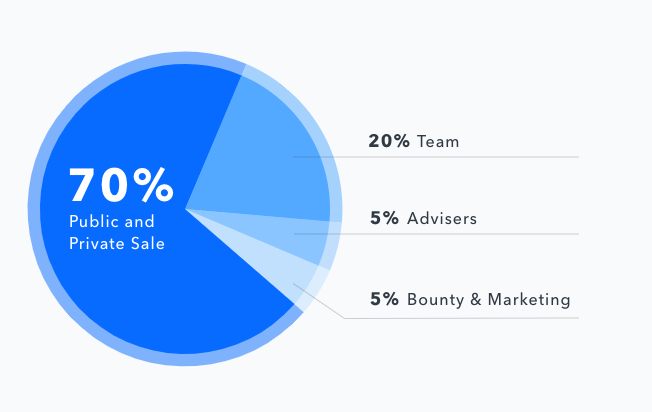

Distribution of tokens:

70% - Public and Private sale

20% - Team

5% - Advisors

5% - Bounty and Marketing

Funds raised from the ICO will be distributed as follows:

40% - Development

25% - Marketing and user acquisition

10% - Legal support

10% - Events

10% - Staff and other company expenses

5% - Reserve Fund

Project Description:

The Daox Ecosystem consists of investors, startups, DAOs and third-party services. Third-party software developers and service providers are integrating their services and tools for startups and investors via Daox Open API, thus fueling the continuous growth of abilities and efficiency.

To interact with the ecosystem and to build DAOs there is the Daox platform. It is a simple and user-friendly interface for startup teams, investors and service providers. The platform is already operating.

The DXC Token is the cryptocurrency for Fundraising DAOs. The DXC token enables all the interactions in the Daox ecosystem. It has a built-in functionality to be easily integrated with third-party services. From a legal standpoint, the DXC is a utility token.

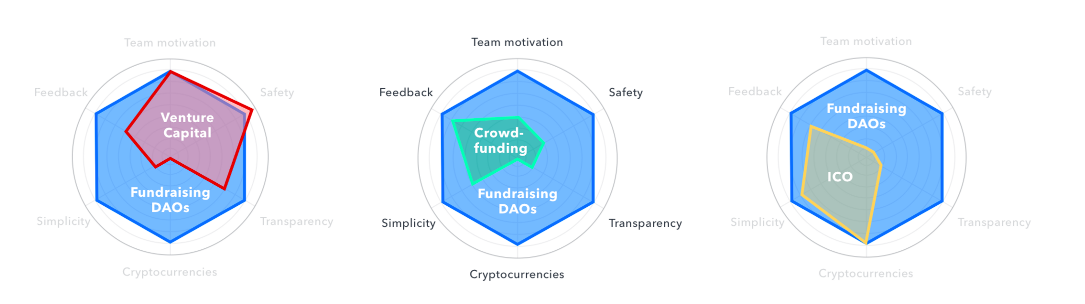

So, Fundraising DAOs combine all the benefits and best practices of crowdfunding, ICO, VC, and blockchain technology, making this kind of entities the smartest fundraising tool nowadays.

Fundraising DAOs play the role of advanced intermediaries between startups and its investors. For example, one of the main principles is that all the collected funds are stored in a DAO instead of being at the disposal of a single individual (or group of individuals). The funds are released based on withdrawal proposals submitted by the startup team. If investors (DAO token-holders) of the startup are satisfied with the way the project unfolds, they approve such requests.

This functionality alone solves the major problems of ICOs and crowdfunding, namely scams and decrease of the team's motivation. If the majority of investors do not see the startup stick to its declared roadmap and obligations, they can simply vote for the refund.

Daox Offers:

Solving current major problems related to crowdfunding and ICOs;

- Innovativeness;

- Implementation of the software solution that will allow to create and manage multifunctional decentralized autonomous organizations on the Ethereum blockchain;

- Customer satisfaction;

- Providing conditions when the key factor for success in attracting investments is potential and quality of the project, not the ability to attract investments;

- Market share growth and worldwide expansion;

- A substantial increase in the popularity of crowdfunding in the society.

Comparison of Fundraising DAOs vs other forms of investing:

Market and Industry Review:

After the sustained growth in the cryptocurrency market throughout 2017, most cryptocurrencies and digital assets underwent a serious downward adjustment in January and early February. The price of the most popular coins and tokens depreciated significantly, to the level seen in early December.

Many experts predicted this downward adjustment, as it happens after every wave of market growth. The bitcoin price trend is usually the signal for market participants, with skyrocketing growth often followed by an average 30–50% fall, leading to a downward adjustment in the price of all altcoins as well. In February total cryptocurrency market capitalization fell by another 15%, from $517 billion to $440 billion at the end of the day on February 28 (https://coinmarketcap.com/charts/). The market also showed a negative trend in March, and by the end of the first quarter of 2018 market capitalization had fallen to $260 billion, to the level at the end of November.

While 2017 was repeatedly called the year of the cryptocurrency, 2018 may well qualify as the year of the ICO. The first quarter of 2018 has been extraordinarily successful from the standpoint of a collection of funds. Right now, based on preliminary assessments, it can be said that more than $7.4 billion has already been collected, which is more than during all of 2017, and this despite a threefold fall in the entire cryptocurrency market over the first quarter. The total funds collected in 2017 equaled around $6.9 billion.

The growth in collected funds in 2018 took place despite the introduction of a number of changes and restrictions in this area related to regulatory processes and the types of tokens being issued (for example, regulation of the issue of tokens by the US Securities and Exchange Commission (SEC) and restrictions on security tokens).

Despite the ban on initial coin offerings in certain countries (China, South Korea), and the need to perform KYC (Know Your Customer) verification procedures, some ICO projects have established mandatory preregistration, limitations on the minimum and maximum amount of tokens purchased, a digital queue for the right to purchase tokens, etc.

Marketing

Information about the project is available via popular services such as Twitter, Telegram, Reddit, Medium, Instagram, Facebook and BitcoinTalk.

The team is active on social media. Twitter and LinkedIn update project news regularly; there is a blog on Medium.

The format of articles about the project shows that they were written mainly at the project's request. Comments: Project has very good numbers on social media; the marketing campaign is being developed mainly on Facebook and Twitter.

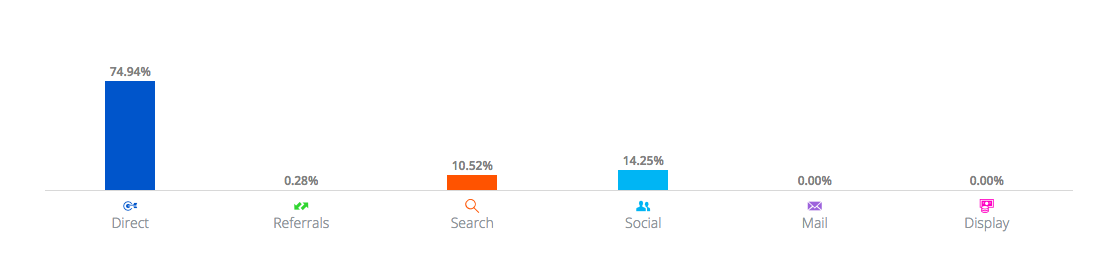

Traffic analysis of the Daox website based on Similarweb.com data showed the following:

Comments: direct link: 74.94%, referrals: 0.28%, search: 10.52%, social media: 14.25%.

Search traffic: 10.52%, 100% from with is organic.

Social activity: LinkedIn: 63.45%; Twitter: 21.90%.

Summary: Based on the available data, the community is interested in the project.

Team:

There is a team of four core team members, along with six advisors.

Key positions are occupied as follows:

Team members:

Oleg Gaidul, CEO

Serial entrepreneur and investor. Founder of Spacemind Capital, EnventVR, AD1, and other successful startups with a yearly turnover of more than $50M.

Work experience:

- Art Dialog Media (2005 - 2010) , Co-Founder and CTO

- Digital Expansion Group (2011 - 2017) , Co-Founder

- Envent VR (2016 - Present), Founder and Advisor

- Spacemind Capital (2017 - Present), Founder

Jordan Pool, Media Director

Jordan brings a lengthy background in live television, digital media production and creative marketing to the team.

Work experience:

- Embermine, Inc (2017 - 2018) , Creative

- Autonio (2018 - Present) , Media Director

Education: Full Sail University (2007 - 2008), specialization - Science

Alex Shevlyakov, Product Lead

More than 12 years of experience in developing tech products. Formerly a product lead for dozens of products each with excellent quality.

Work experience:

- Zotto Media (2014) , Senior iOS Developer

- Digital Expansion (2014 - 2016) , Technical Team Lead

- EnventAR (2017) , iOS/AR Engineer

- Robochat.io (2016 - Present) , Lead Product Engineer

Education: Saint Petersburg State University of Aerospace and Instrumentation (2001 - 2007), specialization - Computer Science

Anton Vityazev, Tech Lead

More than 5 years in web development. High-load and complex systems architect. Blockchain expert. Master's degree in cybersecurity.

Work experience:

- MobileUp LLC (2016 - 2017) , Backend Developer

- Envent Technology LLC (2017 - Present) , Lead Backend Developer

Education: ITMO University (2011 - 2017), specialization - Computer and Information Security

Advisors:

Keith Teare - Executive Chair at Accelerated Digital Ventures.

George Kimionis - Serial entrepreneur and investor with multiple founded companies and multiple exits.

Andrea Brignone - Andrea has a vast experience in financial markets and cybersecurity. He is an author of almost 200 articles on finance and computer science.

Mihai Milea - Over 10 years of experience in global Forex & CFD brokerages, holding various strategic positions in Technology and Digital Marketing.

Kyle Asman - Kyle has extensive experience helping clients raise capital in the finance, banking, regulatory consulting space, and most recently, developed complex international tax structures in the tax advisory space.

Dr. Walter Tonetto - Technopreneur and ASEAN expert. Visiting Professor at the Univ of Tokyo & Waseda. Co-Founder of Indoblockchain.id.

Investment Risks:

This industry is highly regulated and it will take some time until cryptocurrencies can be viewed as a standard asset, inter alia, collateral asset. At this point, it is hard to say anything about the regulators’ stance regarding such services.

Since the project’s potential market is a part of the cryptocurrency market, its cap and dynamics will be of utmost importance. For example, in November 2017 the market cap was $200 billion and it reached $800 billion by January 2018. Today it is approximately $340 billion. This is the potential volume of a highly volatile market. We think it is a major risk for the project because a protracted decline of the cryptocurrency market and/or loss of interest in the cryptocurrency can negatively affect the turnover, liquidity and demand for the platform.

Total Rate: